As the year wraps up, many employers, and retirement/benefit plans impose deadlines that affect 401(k) contributions, flexible spending accounts (FSAs), health‑savings accounts (HSAs), and other benefits. Missing these dates can mean losing benefits, forfeiting tax advantages, or violating compliance rules.

What Workers Should Do Before Year-End

- If you participate in a retirement savings plan (401(k), 403(b), 457, etc.), check your paychecks and payroll deductions — ensure that your contributions for the year are complete by December 31, especially if you want to take full advantage of annual contribution limits.

- For employees aged 73 or older (or those required to take distributions), Required Minimum Distributions (RMDs) must be completed by December 31.

- For many flexible‑spending accounts (FSAs), any unspent balance may be forfeited if not used by the end of the plan year, unless the plan allows a grace period or limited carry over.

- Confirm with your employer/HR that any bonuses, final paychecks, or PTO payouts are processed in a way that counts toward the current year (if that matters for taxes or benefit calculations). Many employers run final payrolls and process bonuses in December. G&A Partners

HSA vs. FSA: Important Differences

- For those with a Health Savings Account (HSA), funds do not expire at year‑end — unused balances roll over, and contributions can often continue (subject to annual limits).

- By contrast, FSAs commonly have a “use-it-or-lose-it” rule: unspent money at the end of the plan year may be forfeited if not spent or claimed.

If your employer offers carryover or a short grace period after December 31, check your plan’s rules before assuming funds are lost.

For workers in Texas, year-end is a crucial time to review your benefits: retirement contributions, FSA/HSA balances, RMDs (if applicable), and benefit elections for the next year. Mark December 31 on your calendar, and if possible, do a quick audit with your employer or HR before then — it’s a simple step that can save you money, preserve benefits, and avoid missed opportunities.

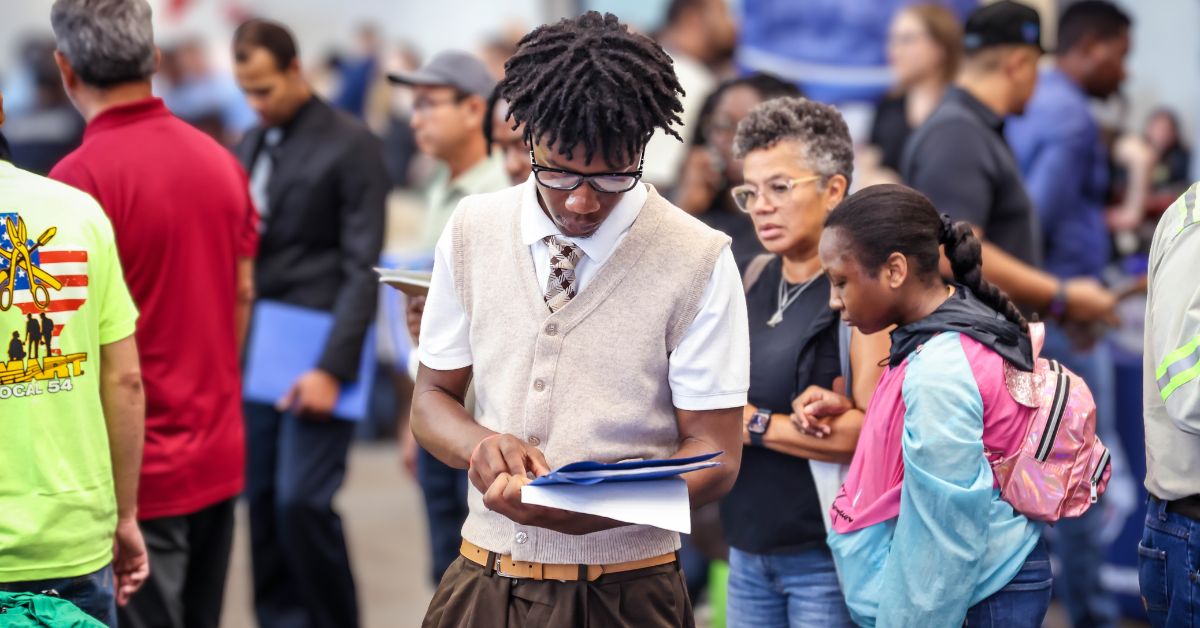

Explore in-demand careers and connect with top employers at upcoming Workforce Solutions hiring events. Register today to secure your spot and access career-building resources.