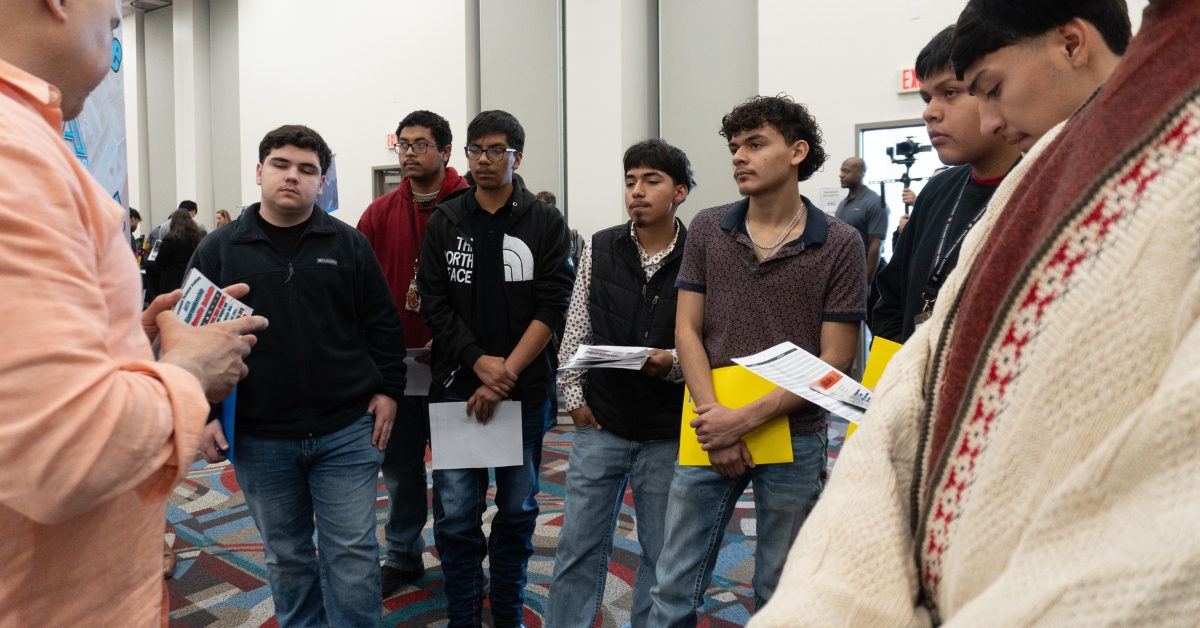

Are you between the ages of 14 and 24 and thinking about your future job or education? The Hire Gulf Coast Youth (HGCY) program could be a great way to begin. It helps you learn job skills, get work experience, and earn money—without going into debt for school.

What Is the HGCY Program?

The HGCY program gives young people paid internships and job opportunities in fields that need workers. You can try out different careers, learn useful skills, and get ready for a future job or college. And the best part? You can do it without taking out student loans.

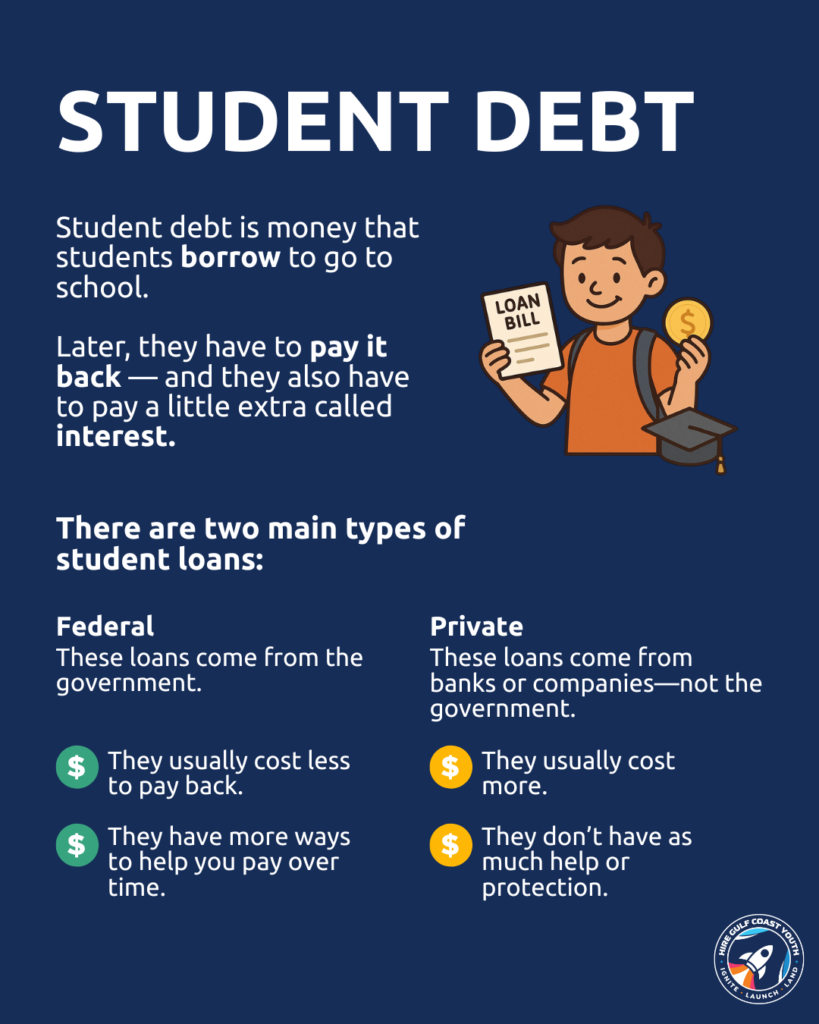

What Is Student Debt?

Student debt is money that students borrow to pay for school. This can include costs like tuition, books, and fees. But loans must be paid back—with extra money added as interest. That means you may owe more than you first borrowed.

There are two main types of student loans: federal and private.

- Federal Student Loans

These are loans from the government. They usually have lower interest rates and more options for paying them back.

- Subsidized Loans: These are for students who need help paying for school. The government pays the interest while you’re in school and for a short time after.

- Unsubsidized Loans: These are for most students. But you have to pay the interest the whole time—even while you’re in school.

- PLUS Loans: These are for graduate students or parents who want to help pay for college. They require a credit check and have fewer repayment options.

The main difference: With subsidized loans, you pay less over time. With unsubsidized and PLUS loans, you pay more because interest builds up sooner.

- Private Student Loans

These loans come from banks or private companies—not the government. They usually have higher interest and fewer protections. If you miss a payment, it can hurt your credit score or even lead to wage cuts.

Private loans make up about 7% of the $1.75 trillion student debt in the U.S., according to the Houston Chronicle.

Why It’s Smart to Avoid Debt

While college can be important, it’s also expensive. Taking out loans means you’ll have to pay them back later—sometimes for many years. That’s why it’s smart to look at other choices first.

HGCY: A Better Way to Start

The HGCY program lets you earn money, explore careers, and learn skills—without taking on debt. You can build a strong future while staying in control of your money.

Joining HGCY is a smart way to try out jobs and prepare for school or work, all while avoiding the stress of student loans.